5 Signs It’s Time to Outsource Accounting Services

5 Signs It's Time to Outsource Accounting Services

Managing your startup accounting function in-house cannot only be a headache but a time-consuming task that eats up a lot of your resources.

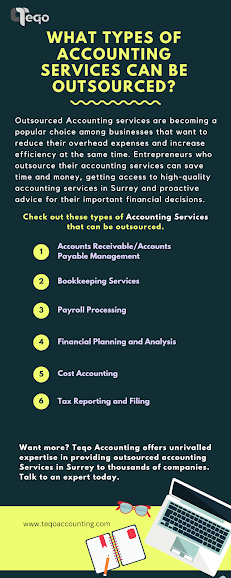

Whether it's payroll, accounts payable, accounts receivable, credit card reconciliation, inventory and budget reports, bank reconciliation, or payroll reconciliation, accounting can often be too much for a small startup to handle.

Five Signs It’s Time to Outsource Accounting Services

How do you know you need help? Here are five signs it’s time to outsource accounting services.

1. Your Books are Messy

Do you feel like you're drowning in time cards, invoices, and receipts? Are your books a mess, and are your bills late?

If you're behind in your bookkeeping and you can't pull out the profit and loss statement for the investors you want, you're in big trouble.

2. You Lack Internal Controls

It is common in the beginning to have one person in the company responsible for writing checks, paying checks, and reconciling bank accounts.

While you can trust someone who has done this, you may not have the internal controls necessary to protect your business. In essence, you have opened yourself up to fraud.

If you have someone handling your debts and receivables, it will be very easy for them to take advantage of your startup, especially if you are too busy to pay attention.

By outsourcing accounting services in Surrey, you immediately set up internal control processes that protect your startup.

3. You Have No Time Left for Strategy

If you spend too much time in the back office taking care of your daily accounting needs, it's time to find some help.

You don't want to be tied down with these mundane tasks, so you don't have time to focus on your business strategy and goals. Your focus should be on growing your business not accounting.

Our Accounting Services in Surrey can help you manage all your day-to-day bookkeeping activities as well as provide you with key performance indicators and help you move your business forward.

4. You Have Cash Flow Problems

Money in, and money out. Do you have a handle on your cash flow?

Many startups fail to submit timely invoices for products sold or services provided. This causes cash flow problems that can damage your startup.

If you don't have cash flow, you can't buy what you need to make products, hire personnel, buy equipment, or upgrade technology.

However, if you have an outsourced Accounting company working for you, you can be sure that your invoices are sent on time so that you are not short of cash flow.

5. Your Business Growth

A large start is very good, but with growth comes more customers, more revenue, more employees, more invoices, and the need to improve financial reporting.

This growth means success for you, and it's high time you add some accounting help.

Additionally, if you need audit support as you grow and continue to grow, our outsourced Accounting Services in Surrey can help.

A final thought

See how long it takes you to balance accounts, sign checks, send and pay invoices, and chase late payments. Compare that to the amount of time you spend growing your company and working with customers.

As a startup owner, you don't have to take care of the back-office business. What's more, you need to update your books, and you need to have access to reports and such, so if you're too busy to do that, let someone else take over.

Outsourcing Accounting Services in Surrey can help you take care of all the things mentioned here, and it makes a good business for many startups to outsource accounting Services.

Are you a new startup ready to succeed? Do you want to start a new business and see success? We are here for you. We can help answer your questions and guide you through the process. Outsource your HR, finance, payroll, and other tasks to us. Contact Teqo Accounting today to get started.

Comments